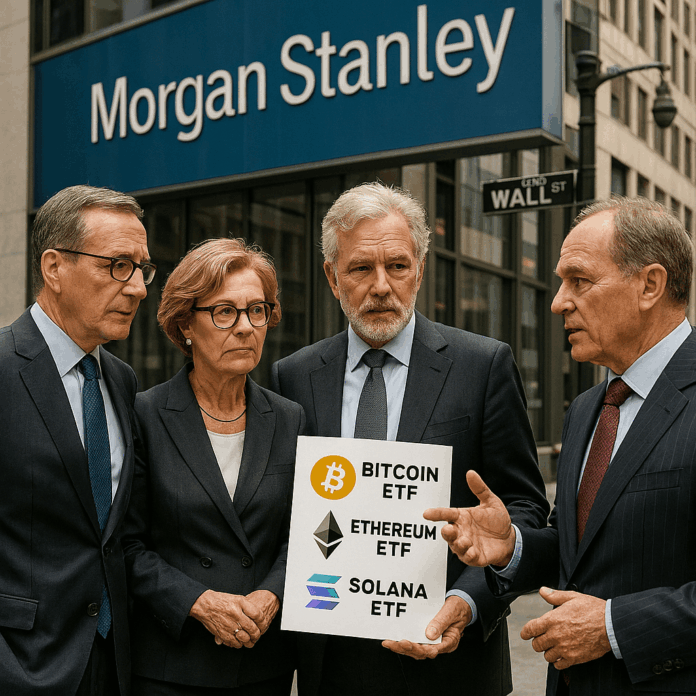

On January 6–7, 2026, Morgan Stanley filed with the SEC for spot Bitcoin, Ethereum, and Solana Trusts, becoming the first major U.S. bank to launch its own branded crypto ETFs. The Bitcoin Trust tracks BTC’s price, while the Ethereum and Solana Trusts include staking rewards for additional yields. Traders view this as a landmark for institutional adoption, potentially channeling billions in client capital.

Wall Street’s Deepening Crypto Commitment

Morgan Stanley, managing trillions in assets, submitted S-1 filings for a Bitcoin Trust, an Ethereum Trust, and a Solana Trust. The Ethereum and Solana products will allocate portions to staking, earning rewards to boost investor returns. This follows Morgan Stanley’s expansion of crypto access to all clients in late 2025, allowing wealth advisors to recommend digital assets.

The filings highlight crypto’s shift from speculative to mainstream. Spot Bitcoin ETFs already hold over $123 billion, with strong 2026 inflows. Adding Ethereum (second-largest crypto) and Solana (high-speed blockchain) diversifies options, appealing to traders seeking exposure beyond Bitcoin. Morgan Stanley’s move could accelerate competition with BlackRock and Fidelity, whose ETFs dominate the market.

With Bitcoin at around $92,000 and Ethereum near $3,200, the filings boost sentiment. The staking feature in Ethereum and Solana Trusts offers income potential, attracting yield-focused traders. Approval would give Morgan Stanley a fast market share gain through its vast client network.

Trader Implications and Next Steps

Approval timelines depend on SEC review under 2025–2026 crypto rules. Traders anticipate inflows similar to Bitcoin ETFs’ $1.1 billion early 2026 surge. The Ethereum Trust targets DeFi demand, while Solana’s appeals to high-performance blockchain users.

Risks include delays or volatility pulling BTC below $90,000 support. However, the bank’s entry validates crypto as a core asset class. As more banks follow, will this spark a new ETF wave?

Disclaimer: This article is for informational purposes only and not financial advice. Crypto investments carry risks.

Follow CoinFTA on X for updates. Visit website for expert crypto insights. Share your thoughts on Morgan Stanley’s ETF filings below!